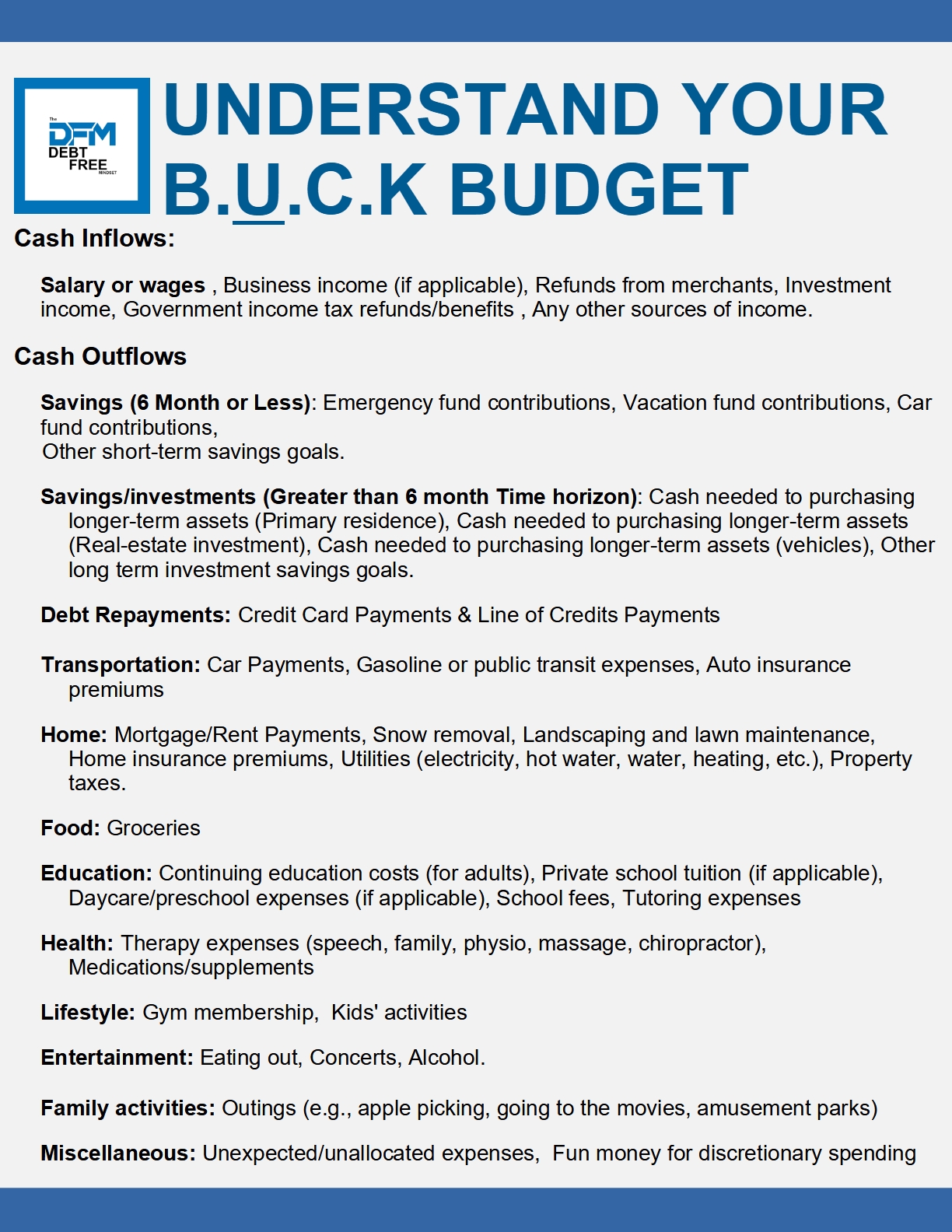

Taking control of your cash inflows and outflows is crucial to assume command of your financial life and achieve true wealth. The Home Budget meticulously dissects your sources and uses of cash within a specified period, typically lasting for a month.

The net cash flow represents the disparity between your total cash inflows and total cash outflows during that specific period. It serves as an indicator of the change in your available cash within that timeframe. Maintaining a balance is paramount in a B.U.C.K Budget, as the net cash flow should always equate to zero. When managing your finances, it is essential to consider your money in terms of three key aspects:

- Scheduled Amount: Determine the planned allocation for each category on a monthly basis.

- Amount Used: Monitor how much of each category’s monthly budget has been utilized thus far in the month.

- Remaining Amount: Assess how much of your budgeted amount remains after disbursing funds within a category.

By embracing this mindset and diligently monitoring your cash flow, you can proactively steer your financial decisions and pave the way towards achieving your desired goals.